How Sonder Abruptly Unraveled After Its Messy Marriott Breakup

In a striking tale of ambition unfulfilled, the hospitality startup Sonder, once valued at nearly $2 billion, has become synonymous with a cautionary story of success turned failure. Known for its promise of luxurious hotel experiences at Airbnb-like prices, Sonder’s rapid ascent was abruptly halted after a tumultuous breakup with its partner, Marriott. With guests left stranded and operations shuttered, the breakdown offers critical insights into the challenges of modern hospitality.

The Rise

Sonder’s journey began with a bold vision: to upend the traditional hospitality model by blending the comforts of home with hotel luxury. Initially embraced by investors and consumers alike, the startup captured attention for its unique approach. The promise was compelling—affordable luxury accommodations in prime locations, catering to the increasing demand for seamless travel experiences. This ethos allowed Sonder to scale rapidly, drawing significant venture capital and achieving a valuation that placed it among the most promising startups in the hospitality industry.

The Turning Point

However, the relationship with Marriott, intended to bolster Sonder’s credibility and reach, proved to be a double-edged sword. The partnership began to unravel as discrepancies in operational philosophies emerged. With both companies failing to align their expectations and processes, tensions rose. Problems came to a head when Marriott unexpectedly severed ties with Sonder, leaving the latter vulnerable in a fiercely competitive market. This pivotal moment could be seen as the beginning of the end for a company that had once seemed poised for greatness.

The Downfall

In the wake of the breakup, the fallout was swift and severe. Guests who had booked stays through Sonder found themselves abandoned, scrambling for alternative accommodations amid increasingly chaotic circumstances. This crisis of trust was compounded by operational difficulties, leading to widespread negative public sentiment. The gap left by Marriott’s exit forced Sonder to reassess its business model, but with momentum lost, days turned to weeks, and the shutdown that followed was stark and definitive.

Marriott Left to Manage the Fallout

Marriott, on its part, was left to navigate the repercussions of this failed partnership. The hospitality giant had its reputation at stake, needing to reassure its customers while addressing the fallout from Sonder’s abrupt closure. Managing the crisis required strategic actions to mitigate damage but also underscored the complexity of business relationships in today’s fast-evolving market.

What Went Wrong?

As the Wall Street Journal delves into this unraveling saga, it serves as a stark reminder of how fragile the balance can be in the startup ecosystem—especially in industries with established players like hospitality. The contrasting visions of Sonder and Marriott, along with misaligned expectations, highlight the intricate dance of partnerships, where the stakes are high and the consequences of failure can be profound.

Sonder’s story resonates beyond a single company’s fate; it offers valuable lessons about adaptability, the importance of solid partnerships, and the volatile nature of innovation in a crowded market. As the dust settles, it’s a poignant reminder that in the world of startups, even the brightest prospects can flicker out in an instant.

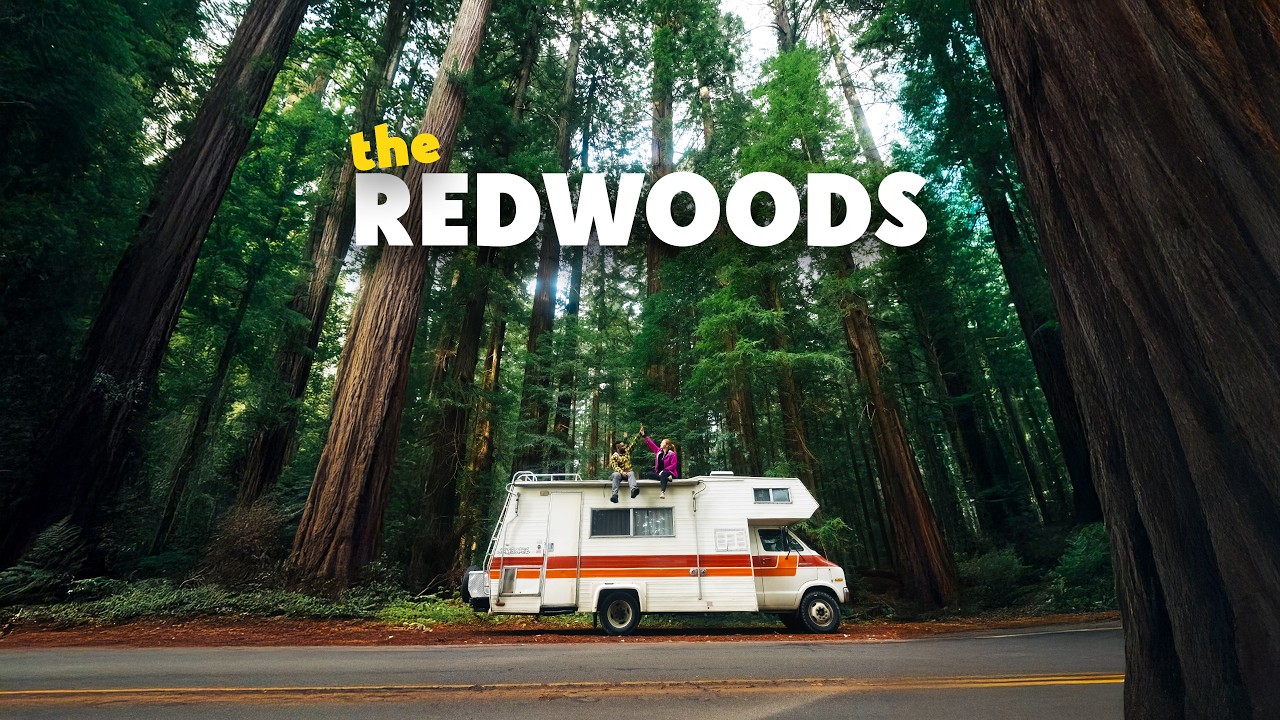

Watch the video by The Wall Street Journal

Video “How Sonder Abruptly Unraveled After Its Messy Marriott Breakup | WSJ What Went Wrong” was uploaded on 11/24/2025 to Youtube Channel The Wall Street Journal

Update video on the Sudan War please! Over 60,000 dead in ONE week.

So it’s financials faltered (or got exposed) during COVID and they went on to a do a series of fund raising without ever solidifying the business model

Financing lets you kick the can down the road but it won’t fix a bad model or poor operations

Never heard of this – thankfully that was a good thing. 😅😅😅😅

I used to work for Sonder. Few months after the CEO purchased a 9 Million dollar mansion, 27% of the staff got laid off using Zoom. They replaced American and Canadian workers for overseas workers, and some with terrible English speaking ability. Glad to see their downfall.

Another SPAC down the drain. Allbirds should consider changing their logo going forward to avoid a Sonder fallout lol.

Not every business should go public

What is the success / failure rates for SPAC’s over all ???

lol, yet another SPAC failure

“The hospitality industry doesn’t understand why people travel…” yeah okay buddy

WSJ == corporate trash

00:47 absolutely, unambiguously, completely wrong. In under 50 seconds every business traveler will recognize that Francis Davidson, former CEO, doesn’t understand the business.

Just so you know, an ambush eviction is definitely “different and unexpected.” How’s that working out?

WSJ is a crooked company.

Take on long term obligation and rent out short term profit. – Wework.

Hold my beer. – Sonder

Read more about Marriott’s disastrous bet on Sonder here: https://on.wsj.com/4p0EiLH