As artificial intelligence (AI) steadily increases its hold on the global economy, one of many areas ripe for disruption is consumer pricing. In situations where different consumers are offered the same product or service at different prices, it is now possible to take the discretion away from staff and use a computer to calculate the best price using a combination of historic pricing data, machine learning capabilities and algorithms.

Airlines such as Virgin Atlantic are using machine learning to offer more competitive airfares, for instance. (You might think airfares are standardised, but actually they are affected by numerous variables, such as where you live). Similarly, banks are heading in this direction with mortgages.

More generally, loan pricing has the potential to be transformed. My research group recently published a paper looking at car loans in North America. By applying machine learning to thousands of lending decisions through dealerships, we found that profits could have been raised by 34%.

However, this comes at a cost: it would mean charging riskier borrowers a little more for their loans than at present. As we shall see, there are some mitigating factors to this, which some might argue even justifies the cost. Either way, it raises searching questions about the future of lending.

The move to variable pricing

Until a few decades ago, prices for loans were the same for everyone. That started changing following the introduction of credit scores in the late 1980s. These were frequently used to make loans slightly more expensive for higher-risk customers.

This was partly to cover the costs of creditors having to follow up on defaults and write off bad debts, and partly because riskier customers are less likely to walk away from loans with more onerous conditions. This is to say, they are less price sensitive than other borrowers – primarily because their options are more limited.

Prostock-studio

When it comes to setting prices, the decisions are frequently delegated to salespeople. The best information on this practice comes from a 2014 study in Germany which found that 72% of firms spanning multiple industries, including financial services, were doing it.

The car loans sector is a classic example. Lenders entrust salespeople in dealerships to determine customers’ loan terms, including interest rates, deposit size and loan duration. For decades, this has been somewhat of an assumed “best practice”. The salespeople’s ability to subjectively assess customers’ price sensitivity at the point of sale has been viewed as a unique competitive advantage. And despite AI’s potential to make more precise decisions using much more data, this sector has barely started using it in loan pricing.

We wanted to quantify the size of the opportunity. We partnered with a car lender in Canada, using its historic data to build a statistical model to account for the critical decisions made by the lender, salespeople and customers. Our algorithm then estimated the impact of different loan prices on a customer’s decision to accept or reject the terms being offered. From there, we could determine the price that maximised profits for the lender.

Our results confirmed that customers respond differently to loan prices, primarily depending on their risk profile. Though their price sensitivity may vary between countries or sectors, the fact that this is a common phenomenon is likely to mean that our findings are widely transferable.

What we found

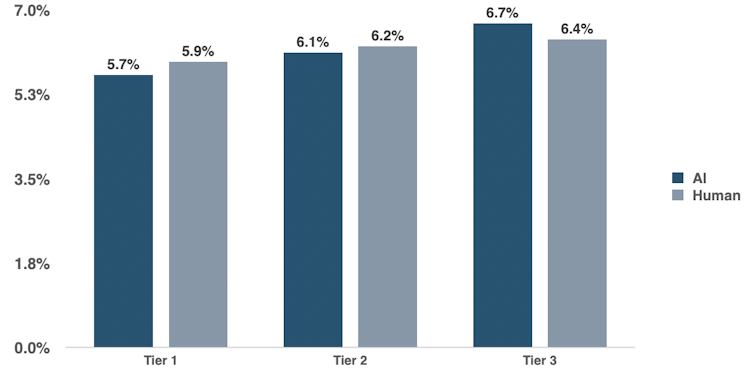

The graph below shows how our algorithm would have repriced loans for our lender partner. The loans get a little cheaper for lower- and medium-risk customers (tier 1 and tier 2), and more expensive for the highest-risk group (tier 3). Whereas the loans offered by the salespeople were already priced about 0.5 percentage points higher on average for tier-3 customers than those in tier 1, the algorithm calculated that dealerships could charge high-risk customers 1.07 points more.

AI v human loan setting

Author provided

The lender would benefit from this because they could collect additional interest for bearing extra risk. On the face of it, the risky borrower is losing out, though it’s not as straightforward as it first appears.

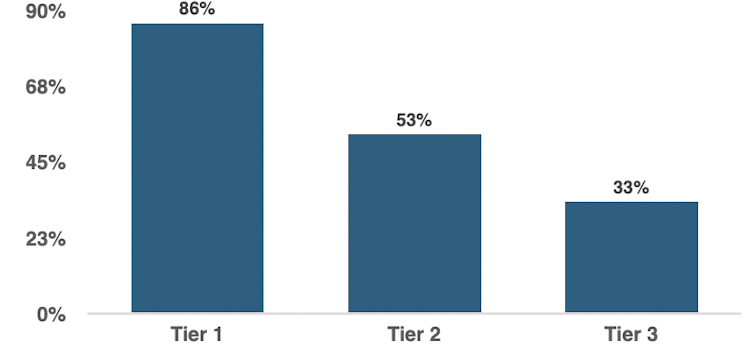

In real life, the lender’s approval rate for loans to lower-risk customers was over 50 percentage points more than for higher-risk customers. We think it’s very likely that using an AI system for pricing would significantly increase the proportion of loan approvals for riskier customers, since lenders would be more fully compensated for doing business with them.

Loan approval rate by risk tier

Author provided

It’s also worth emphasising that the increased difference in loan prices using the AI system is small. On a three-year loan of £20,000 (C$34,338), it’s the difference between £658 per month for low-risk customers (at 12% APR) and £668 per month for high-risk customers (at 13.1% APR).

What next

According to our findings, good-quality data can substitute for the intel that salespeople can generate on the salesfloor. In such circumstances, AI-based centralised pricing is the clear winner in the race for profits.

It’s extremely likely that lenders will want to take advantage of these new technologies in the years ahead, despite having been slow to adopt machine learning for pricing decisions thus far. In anticipation of this shift, fairness has already come up as an issue: UK financial regulators warned banks a while ago that they could only use AI for loans if they prove the approach doesn’t disadvantage those who already find it difficult to get loans.

As we’ve seen, high-risk borrowers can be both advantaged and disadvantaged by this technology. As companies increasingly want to move to these models, the discussions about the pros and cons are only likely to intensify.

The post “AI has the power to revolutionise lending, but at a cost to people with lower credit scores” by Christopher Amaral, Assistant Professor of Marketing, University of Bath was published on 04/16/2024 by theconversation.com