In Brussels, the talk of the town is a report on the future of European competitiveness, calling for fundamental economic reforms to avoid a “slow agony” for the European economy. The report, by former president of the European Central Bank Mario Draghi, is a “door stopper” of 400 pages, including both broad messages as well as hundreds of detailed recommendations.

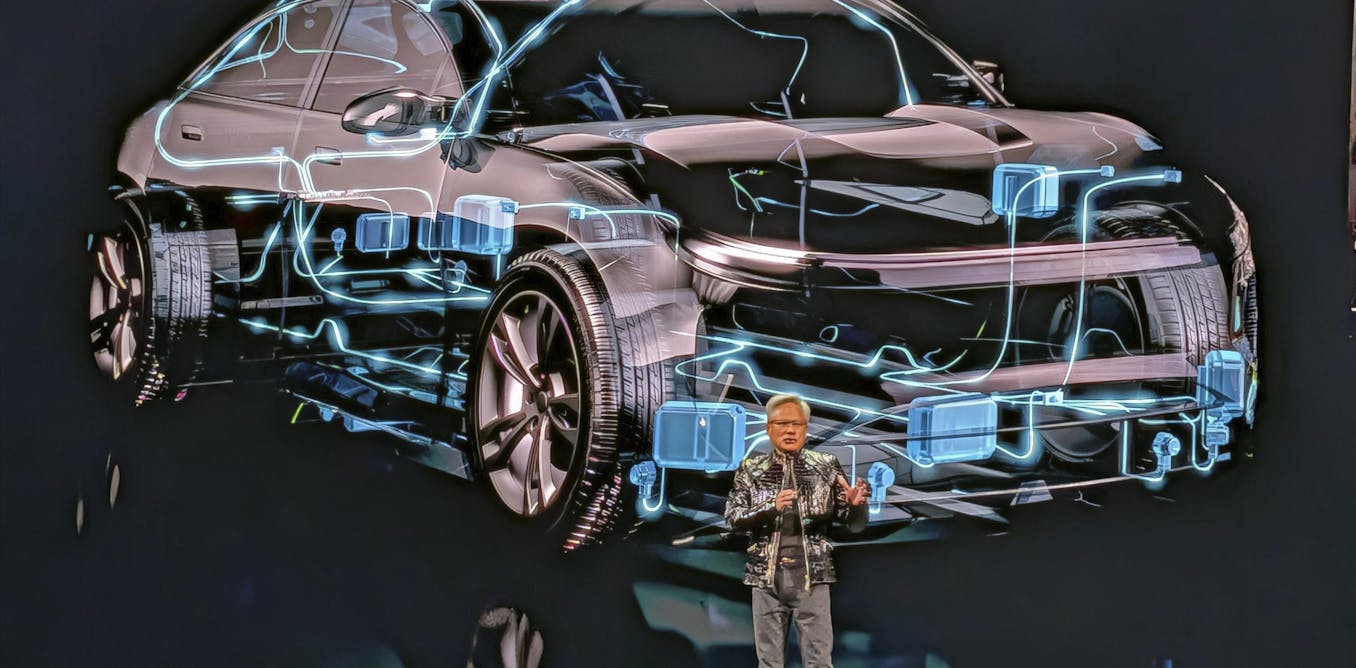

The starting point of the report is the weakness of innovation in the EU. It lays out the lamentable state of Europe’s high-tech industries. Draghi recognises that European enterprises are caught in a “middle-tech trap” – dependence on mid-tech industries like car-making that tend to offer less growth potential than their high-tech counterparts.

Most large EU companies are in middle-tech sectors and remain there because they consider it too risky to go into new ones. This is why radical, breakthrough innovation is much weaker in Europe than in the US.

Draghi proposes several small but significant steps that should strengthen innovation, like the creation of a European version of the US research and development body the Defense Advanced Research Project Agency (Darpa) that has been credited with fostering innovations like the internet.

Competition from China

The report often has a confusing message, especially on the role of competition. It recommends, rightly (and courageously), abandoning sectors like solar panel manufacturing, where the Chinese cost advantage is too big – even if that advantage is due to subsidies.

But it considers the automotive industry too important to be exposed to unfettered Chinese competition. As such, it recommends a mixture of tariffs to protect EU industry. As the EU is already letting Chinese solar panels dominate its market and has imposed tariffs on Chinese electric vehicles (EVs), this stance is hardly revolutionary. It is merely what is being done already.

More novel (and disconcerting) is the idea that if tariffs fail to protect the European EV sector, the EU should force Chinese investment in this sector to include a transfer of technology. This would put the EU on a par with developing countries. But this is exactly the approach China has used for a long time and which the EU has criticised. It forced EU companies to reveal their technology, which Chinese firms then used to compete.

The report also mentions competition more than 150 times and underlines its importance for growth and innovation. But then it recommends suspending competition rules even when a merger creates a dominant market position, if the companies promise to invest in innovation.

At first glance, this looks like a reasonable policy. But one wonders how to measure the innovation benefits a large dominant company can yield, and how any promises to increase innovation spending would be monitored.

VIZ UALNI/Shutterstock

A major headline-grabber was the €800 billion (£675 billion) of additional annual spending that Draghi says is needed to achieve the report’s objectives. Yet the document devotes only a few paragraphs, and one short table, to this eye-watering figure. Of the €800 billion, €450 billion is related to the green transition and most of the remainder is earmarked for digital and innovation.

The report says only that these numbers are based on estimates from the European Commission and also argues that the €800 billion, which would be more than 4% of GDP, is probably an underestimate. But this has not really been picked up in the public discussion.

And without a solid basis for such a large number it is difficult to assess one of the central tenets of the report – namely that unprecedented investment is needed to get Europe growing.

Observers are left wondering why this amount would be needed over and above existing investment, and which specific projects should be financed.

The report does not say directly that the €800 billion annually should be financed by the EU through borrowing, only that private financing will not be sufficient. But the message that has caught the public imagination is naturally the big headline figure.

However, the data does not actually suggest that Europe needs much more investment. A recent report shows that investment in the EU is higher as a share of GDP than it is in the US.

So it does not make sense to call for a large increase in investment without specifying what kind of investment is missing. The main EU-US difference is spending on research and development (R&D), which is much stronger in the US because its high-tech companies spend so much more.

But there is little detail in the report on how the EU would foster hundreds of billions in R&D spending to make EU companies leaders in high-tech sectors, an aim that the EU has implicitly had at least since the ill-fated Lisbon Agenda. Under this agreement, signed in 2000, R&D spending was planned to rise to 3% of GDP – but this goal was never reached.

All in all, the Draghi report does not seem to offer a radically new direction for EU economic policy. It confirms existing tendencies to support innovation, going soft on competition enforcement, increasingly protecting industry against Chinese competition and subsidising investment. The scale of the recommended investment is the main innovation. But it makes little sense until one knows what all this money should be spent on.

The post “The EU’s latest proposal to save its economy aims to avoid a ‘slow agony’ – but it lacks bold ideas” by Daniel Gros, Professor of Practice and Director of the Institute for European Policymaking, Bocconi University was published on 09/19/2024 by theconversation.com

Leave a Reply