On a turbulent Monday, international markets faced a sharp sell-off as stocks plummeted across Asia and Europe in response to US President Trump’s recent announcement of tariffs. The situation was particularly grim in Asia, with Hong Kong’s Hang Seng index taking a major hit, closing more than 13 percent down. The sell-off extended from China to Australia, highlighting the widespread impact of the news.

In Germany, the main DAX index also experienced a significant drop of around 10 percent at the start of trading, before recovering some of its losses. The uncertainty surrounding the implications of Trump’s tariffs has clearly rattled investors worldwide, leading to a wave of panic selling.

In an attempt to make sense of the situation, Senior economist Trinh Nuyen from the financial services firm Natixis shared insights with DW News regarding the potential consequences of the trade war on the global economy. The looming threat of a recession caused by escalating trade tensions has understandably heightened concerns among market participants.

Additionally, DW reporter Steven Beardsley shed light on the future prospects of Trump’s tariff plans and the impact they could have on trade relations globally. As uncertainty continues to reign supreme in the financial markets, investors are bracing themselves for further turbulence and volatility in the days to come.

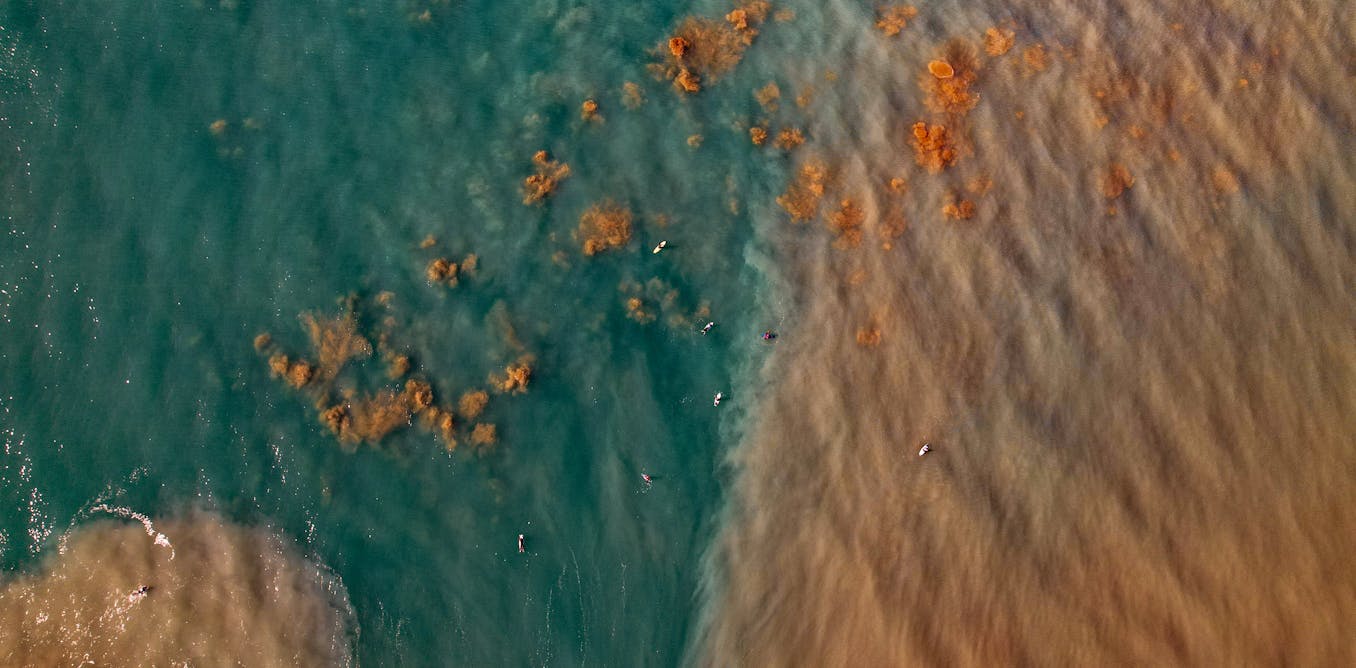

The sharp sell-off in Asia markets serves as a stark reminder of the interconnectedness of the global economy and the ripple effects that geopolitical decisions can have on financial stability. As investors navigate uncertain waters, the need for clarity and resolution in trade negotiations remains paramount to restore confidence in the markets.

Watch the video by DW News

Video “What’s behind the sharp sell-off in Asia markets? | DW News” was uploaded on 04/07/2025 to Youtube Channel DW News

😂😂😂

Economic bulling that all other countries have done to the USA

When I was in Japan I almost NEVER seen American products on the shelves

The Whitaker family in the White is crashing the world. Vladimir Putin is proud of Comrade Trump! 😂😂😂🤡

The chinese have slapped reciprocal tarrifs and with the tax collected from tarrifs on their end they subsidize buisnesses to soften their blow from us tarrifs.

Not only this but vietnam which just got a 0% tarrif deal, chinese buisnesses that have been set up there are just gonna continue as usual with 0 consequence and since most Vietnamese are angry on their and us gov have stopped buying us goods as a whole. Whats the use of tarrifs if no one buys any product

Its insane, trump has been check mated already and he doesn't even know he lost 😂😂😂

Drop all trade barriers… not just the tariffs…

SHORT SELLING : Trump is making a huge fortune by short-selling tons of securities through a few traders allowed by Stock Exchange to do that. When he has done 1 or 2 Billions of profit, he will resign.

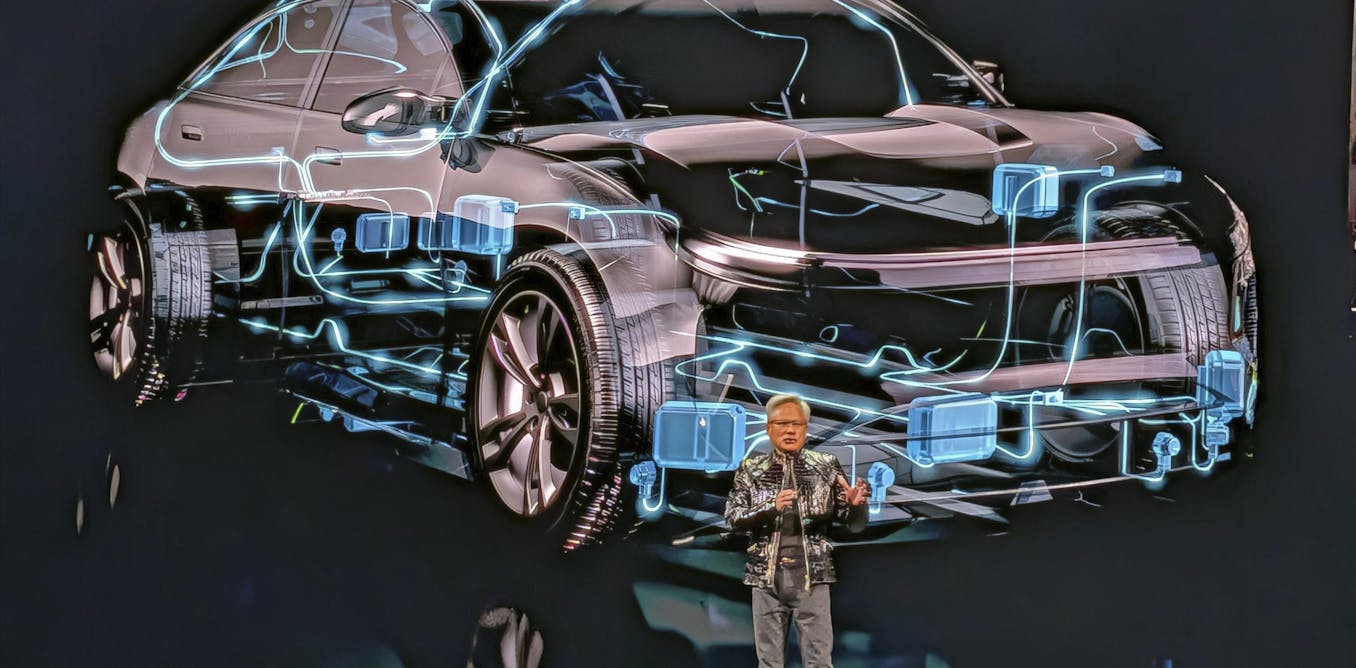

The New World is driven by innovation and digital transformation.

Rain shows us that beauty exists even in the storm

Trump has been losing money and leading failed business ventures his entire life and now wants everyone to lose while he enriches himself.

US products are sub-standard, that's why EU consumers don't want them. 🤷

China's products have no quality period even in middle east locals dont like made in China especially sell by TEMU.

Whole market is f-d up. Only two things will come out of tariffs- first it will bring recession in world or it will bring everyone to table and globalisation will be dead. Multilateralism will rise where people will trade based on their needs with countries aligned with their ideology.

Answer is no

" many economies rely on exports to the US " , exactly ! "Europe may need to consider tariffs on China so all that cheap stuff … doesn't undercut stuff here " Wow , it's almost like you get it !

Without US China is nothing

Even the great China has fallen. The assumption that the US is weak falls flat on its face

Most of the large meat companies are Chinese owned in the US.

Why does he act like he’s above everyone else?

Humans never learn..trade wars was being done in the 1930's prior to WW 2 and here we go again.

Anti American sentiments on rise thankz to trump

1:26 you taxed Americans for ever so what are you talking??

Actually every country taxed Americans, Americans never replied and every country Raped American System.

Germany want Orange guy?

50% more taffies until solo leveling season 3. Get to work lol 😅

The cause of the world's problems is the Israeli lobby in USA. Free world from AIPAC

Only China has the balls in Asia let’s see if the EU have a pair or be as neutered as British government.

MAGA

2:14 y? China india is exporting on zero percent to usa but nothing from usa can enter indiachina without tax why?

America should tax indiachina 300% so that these governments are also forced to make american imports at zero % import duties.

Indiachina are worst countries for american imports.

the media is causing panic

More than that. Asia won't have much of a choice, nor does the rest of the world but to trade efficiently without considering the USA. A long term tragedy to them, leaving scars that won't heal anytime soon.

US debt must be reduced so the good times have ended SO if you want to sell your goods to the us consumer then balance your trade or pay.

Hilarious the CCP accuses the US of economic bullying… what hypocrites!

MAGA getting woke to their 401k decline. Oh, the irony. 😅