Dubai is hosting the 80th IATA Annual General Meeting (AGM) and World Air Transport Summit. Over 1,500 key decision-makers from airlines, industry partners, manufacturers, and media have gathered to discuss critical issues facing the air transport sector.

This annual event, hosted by Emirates focuses on navigating geopolitical and economic challenges, charting a sustainable path forward, and exploring the potential of Artificial Intelligence in the future of air travel.

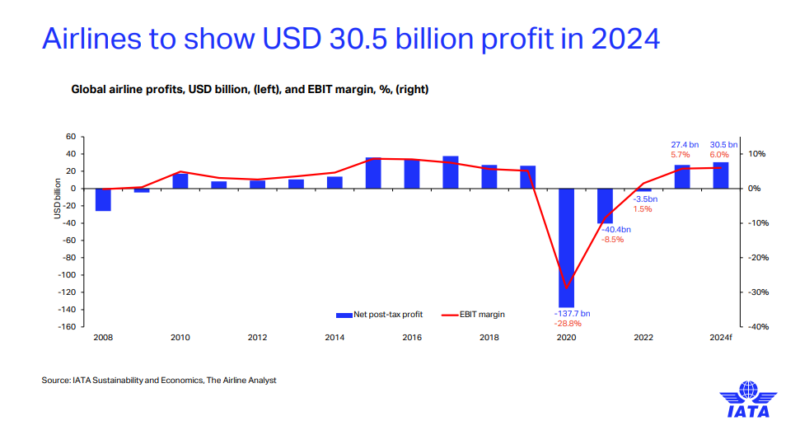

IATA announced strengthened profitability projections for airlines in 2024 compared with its June and December 2023 forecasts. Here are some key takeaways.

Profitability on the Rise, But Challenges Remain

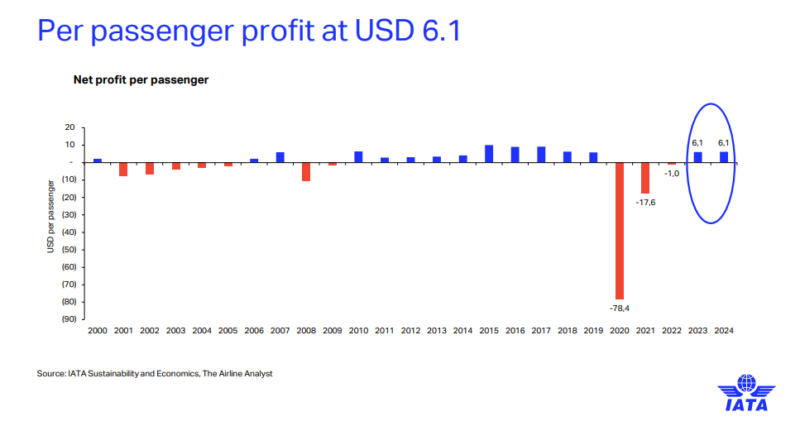

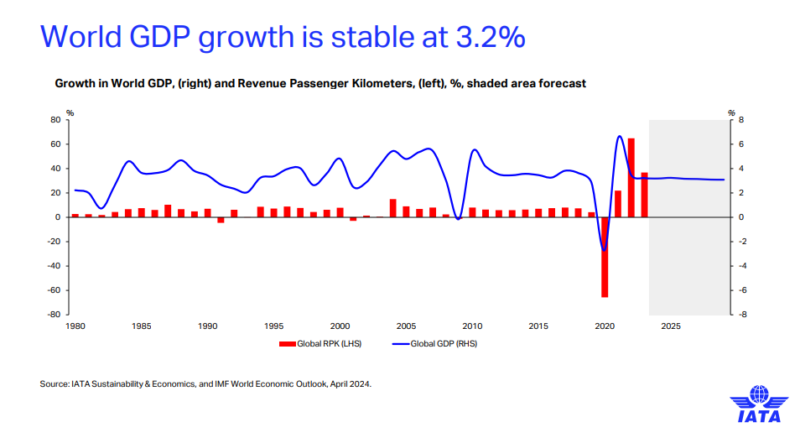

Airlines are expected to see improved profitability in 2024 with a net profit of $30.5 billion, exceeding the previous forecast of $25.7 billion predicted in December. The strong travel demand is reflected in the record-breaking number of passengers expected in 2024. Airlines are projected to carry a staggering 4.96 billion passengers, surpassing all previous highs.

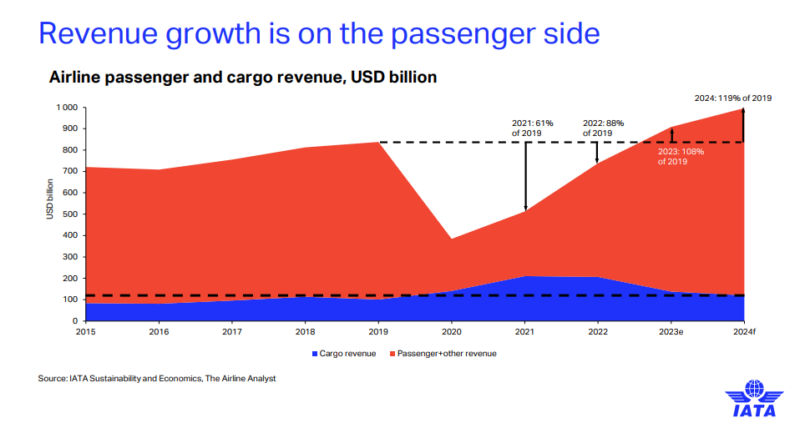

Moreover, total revenues are projected to reach a record high of $996 billion in 2024, driven by a 9.7% increase. The expenses are also expected to reach $936 million, compared to the previous estimate of $914 million.

IATA predicts a positive profit outlook across regions, with North America leading the pack at $14.8 billion. Similarly, Europe is expected to see $9.0 billion in profits, followed by the Middle East at $3.8 billion. Asia-Pacific airlines are projected to reach $2.2 billion in profits, with Latin America at $0.6 billion and Africa at $0.1 billion.

However, the per-passenger profit stands at just $6.1. This highlights that the industry remains below the average cost of capital, highlighting the need for further progress on cost control and efficiency measures.

While profitability is on the rise, airlines remain focused on sustainability efforts. Sustainable Aviation Fuel (SAF) production is projected to meet 0.53% of global demand in 2024, showcasing the industry’s commitment to reducing its environmental impact.

Cargo Market Shows Signs of Normalization

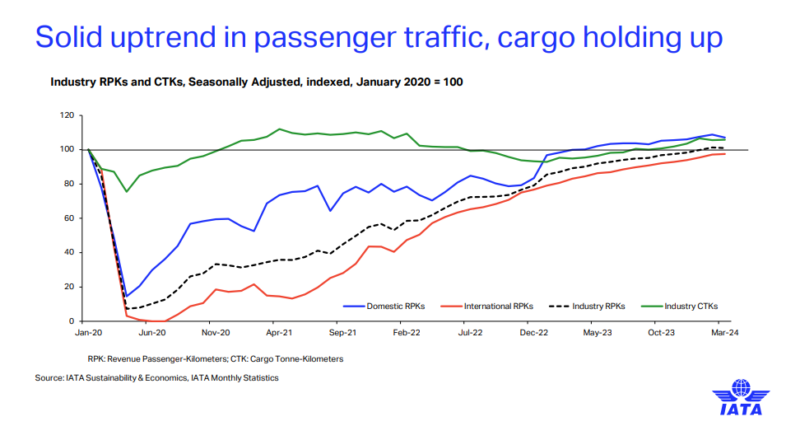

Cargo revenues are expected to see a slight decline in 2024, dropping to $120 billion from $138 billion in 2023. This is a natural correction following the exceptional year during the pandemic, as more belly cargo space becomes available post-pandemic.

The projected revenue for 2024 sits at $120 billion, down from $138 billion, but still above pre-pandemic (2019) levels of $101 billion. This trend reflects a normalization of the cargo market after the extraordinary boom witnessed during the pandemic.

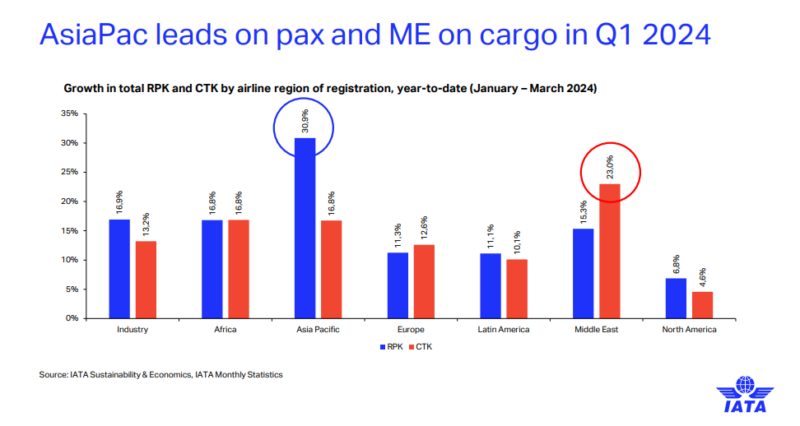

In the first quarter of this year, the Asia-Pacific region leads the passenger market whereas the Middle East leads the cargo market with a year-on-year growth of 30.9% and 23% respectively.

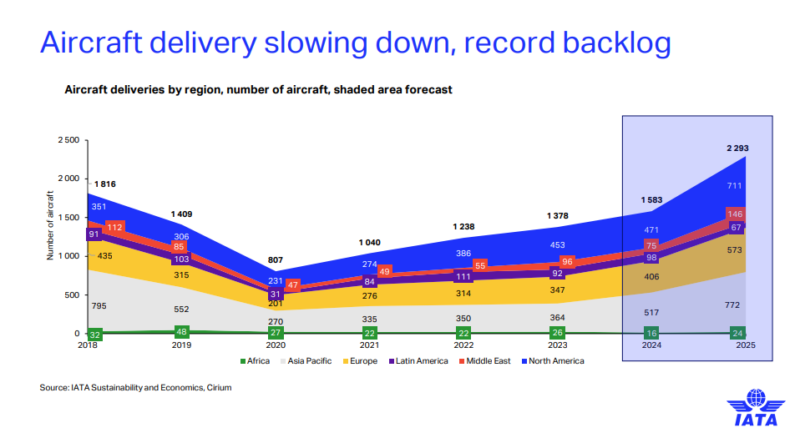

Delivery Slowdown, Record Backlogs

As highlighted in the event, the aviation industry is facing serious supply chain challenges related to aircraft deliveries and spare parts.

Recently, IATA’s President, Willie Walsh, stated that aviation supply chain issues will persist for years. He anticipates a 3.3% annual growth in aviation over the next 20 years, with strong growth in Asia. He called for increased production of sustainable aviation fuel, urging governments to provide incentives for this initiative.

New aircraft deliveries are being delayed due to supply chain and quality issues. This issue is expected to grow the aircraft backlogs to a record-high number into 2025.

Reduction in Blocked Funds

IATA reported a positive development for airlines, with a 28% decrease in government-blocked funds. The total blocked funds at the end of April stood at approximately $1.8 billion, a reduction of $708 million (28%) since December 2023.

Moreover, IATA also reiterated the call for governments to remove all barriers to airlines repatriating their revenues from ticket sales and other activities following international agreements and treaty obligations.

“The reduction in blocked funds is a positive development. The remaining $1.8 billion, however, is significant and must be urgently addressed. The efficient repatriation of airline revenues is guaranteed in bilateral agreements. Even more importantly, it is a pre-requisite for airlines—who operate on thin margins—to be able to provide economically critical connectivity. No business can operate long-term without access to rightfully earned revenues.”

Willie Walsh, IATA’s Director General.

The main driver of the reduction was a significant clearance of funds blocked in Nigeria. Egypt also approved the clearance of its significant accumulation of blocked funds. Despite this, in both cases, airlines were adversely affected by the devaluation of the Egyptian Pound and the Nigerian Naira.

| COUNTRY | AMOUNT US$ MILLION | MONTHS HELD |

|---|---|---|

| Pakistan | 411 | 40 |

| Bangladesh | 320 | 40 |

| Algeria | 286 | 37 |

| XAF zone | 151 | 50 |

| Ethiopia | 149 | 58 |

| Lebanon | 129 | 52 |

| Eritrea | 75 | 116 |

| Zimbabwe | 69 | 84 |

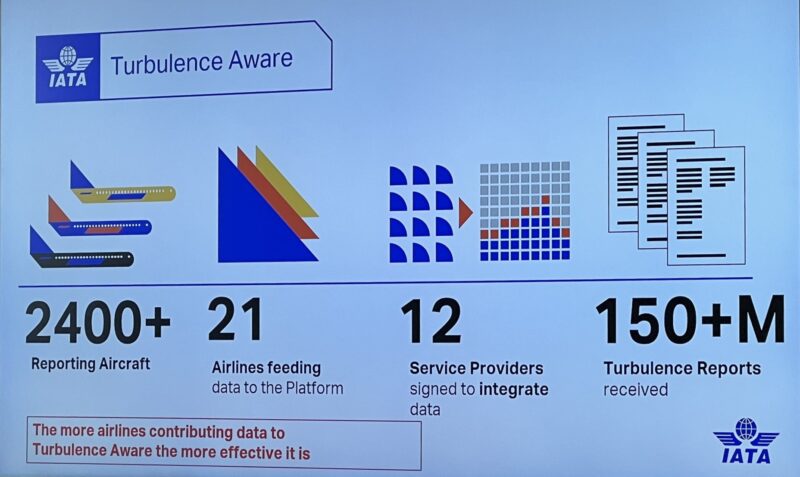

IATA’s Turbulence Aware Platform

At the IATA AGM in Dubai, Sam was given a demo of the IATA Turbulence Aware. The recent incident of Singapore Airlines flight SQ321 has sparked curiosity among travelers regarding turbulence. Currently, 21 Airlines are contributing and able to access accurate, objective, aircraft-generated data.

Emirates has recently joined the Turbulence Aware Platform, becoming the first airline to integrate the IATA platform within the latest version of Lido mPilot, the mobile navigation solution from Lufthansa Systems.

In conjunction with the IATA Turbulence Aware Platform, Emirates has equipped more than 140 aircraft with the required onboard software to automatically share turbulence reports with all airlines contributing data to the platform.

Fiji Airways, Oman Air Joining Oneworld Alliance

Fiji Airways has today been announced by oneworld as its 15th full-member airline, building on its previous status as a oneworld connect partner. During the past five years, as an oneworld Connect partner, the carrier developed cooperative links with all oneworld member airlines, paving its way to a more seamless integration as a full oneworld member.

The Nadi-based carrier’s transition to full membership will begin immediately and is expected to be completed within the next 12 months.

“I am extremely proud to announce our full membership in the award-winning oneworld alliance, marking a significant step in our commitment to providing unparalleled service and connectivity. As a full member airline, we are excited to enhance the travel experience for oneworld alliance frequent flyers, offering greater accessibility to Fiji and the South Pacific, and ensuring seamless connections and memorable journeys for Fiji Airways customers across the alliance network.”

Andre Viljoen, the Managing Director, and CEO of Fiji Airways.

As a full oneworld member airline, Fiji Airways will provide oneworld Emerald, Sapphire, and Ruby customers with a full suite of oneworld benefits including earning and redeeming miles, earning status points, priority check-in, and boarding and lounge access.

IATA’s 81st AGM in Delhi

IATA has also announced Delhi, India as their host country for the 81st IATA AGM and World Air Transport Summit in 2025. Low-cost carrier IndiGo (6E) will take the helm as the host airline for the annual event, which will take place from June 8-10.

The event returns to India for the third time, following gatherings in Delhi in 1958 and 1983.

“After 42 years, the IATA AGM return to India comes at a very appropriate time with the global rise of India and Indian aviation. India is emerging as one of the world’s largest and fastest-growing civil aviation markets. Over the past 18 years, it has been IndiGo giving wings to the nation, by connecting people and aspirations. This recognition now is truly a very proud moment for all of us at IndiGo,”

Pieter Elbers, IndiGo CEO

Featured Image via Emirates

Related

The post “Key Insights of the Airline Industry: IATA AGM 2024” by Sharad Ranabhat was published on 06/04/2024 by samchui.com