In mid-April 2025, a wave of videos swept through TikTok claiming that some brands of luxury leather goods, especially French ones, actually make their products in China. The content creators presented themselves as official manufacturers, urging customers to buy bags directly from the source at a fraction of the retail price.

What triggered these campaigns? What caused them to spread so widely? Amid geopolitical tensions and legal challenges, this phenomenon raises crucial questions about business practices and intellectual property rights.

The United States: a luxury growth engine

The carefully orchestrated release of these videos coincided with the United States’ announcement of 145% tariffs on Chinese imports. With the use of catchy titles like “Luxury Brands Are All Made in China” or “Luxury Brands Lied to You”, content creators sought to draw customers directly to Chinese websites. This way, they would have a chance to bypass traditional distribution channels.

By offering their products on Chinese applications such as DHGate or Taobao – among the most downloaded in the United States in mid-April – Chinese manufacturers were clearly targeting the US market.

And indeed, the US is one of the most important markets for the luxury sector. In 2024, the country accounted for 25% of sales for French group LVMH, the world’s leading luxury goods company. Hermès, for its part, generated 19% of its revenue from “the Americas”, a 15% increase from 2023.

Even more interesting: while China is showing signs of slowing down for many major players in the sector, the US is once again becoming the engine of growth in a luxury market that is stabilising. According to “The State of Fashion: Luxury”, a study by the Business of Fashion (BoF) and McKinsey published in January 2025, sales of personal luxury goods in the US market are expected to increase by 3% to 5% for 2024 and 2025, and by 4% to 6% from 2025 to 2027 – compare this to 1% to 3% growth for the global luxury market from 2024 to 2025, and 2% to 4% growth from 2025 to 2027. What’s more, the US is likely to surpass China’s expected growth of 3% to 5% for the 2025-2027 period.

And according to BoF and McKinsey, sales of luxury leather goods registered the strongest growth between 2019 and 2023, even exceeding $79 billion in 2023. This high demand is driven by purchases of items considered “investment pieces” such as the “Timeless” bag by Chanel, the “Neverfull” by Louis Vuitton, the “Arqué” by Prada, and particularly coveted models like Hermès’ “Birkin” and “Kelly”.

Almost exclusively European productions

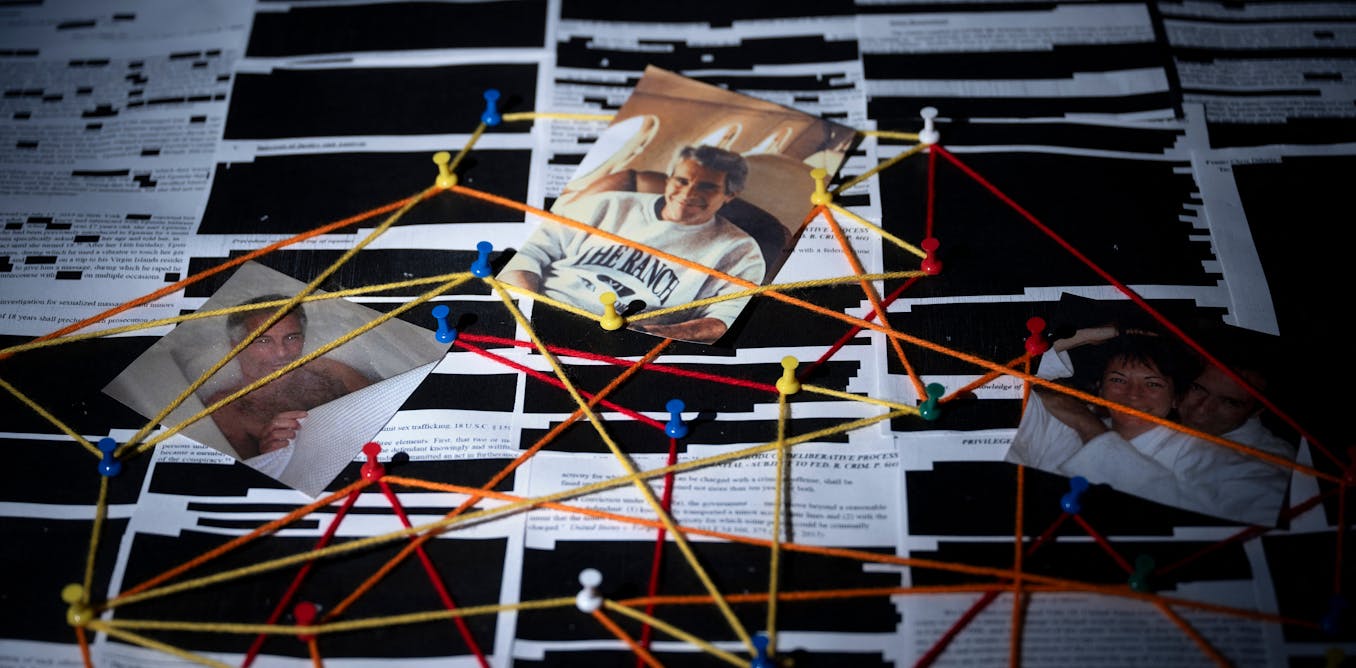

The Chinese manufacturers behind the claims in the videos on TikTok explain their previous silence by citing confidentiality agreements. They seized the opportunity to convince Internet users that these iconic Italian or French brands had their leather goods produced in China, with the “Made in Italy” or “Made in France” labels added only after the final assembly step was carried out in Europe.

However, by showing bags resembling those made by Hermès and Louis Vuitton, the creators of these videos ultimately discredited their own claims.

Make no mistake: Hermès does not produce its bags in China. As stated in its 2024 universal registration document, 60 of its 75 production sites are in France. The others can be found in Italy (shoes), the United Kingdom (for the bootmaker John Lobb, which is owned by Hermès), Switzerland (watches), Australia (tanneries and precious leathers), the US, and finally Portugal, with two metal factories there – neither of which is involved in making bags.

The coveted quality of Hermès’ creations stems in large part from its craftsmanship-based business model, with expertise passed down through generations and training provided in the company’s own schools. Its bags are produced exclusively in France and are labelled “Hermès Paris”. For connoisseurs, that’s a given!

As for the Louis Vuitton bags, pages 395 and 396 of LVMH’s 2024 universal registration document reveal the list of Louis Vuitton workshops – most of which are located in France. Some production takes place elsewhere in Europe (notably in Italy, Spain, and Portugal to a limited extent), as well as in the US, where the company operates a workshop in Texas. Here again, there is no evidence of any production in China.

In the case of Hermès and Louis Vuitton, the products shown in the videos are flagrant counterfeits. Customers tempted to buy directly from China expose themselves to significant risk. Buyers, if caught, may face serious penalties.

‘Approximately $467 billion’ in global trade

According to the latest data in “Mapping Global Trade in Fakes 2025”, a report published by the Organisation for Economic Cooperation and Development (OECD), counterfeit goods (across all categories, from pharmaceutical to spare parts) made up “approximately $467 billion” in global trade in 2021, “or 2.3% of total global imports”. Counterfeit imports into the EU were “estimated at $117 billion, or 4.7% of total EU imports”.

While all sectors are impacted, “clothing, footwear, and leather goods remained among the most affected sectors, accounting jointly for 62% of seized counterfeit goods” in 2020-2021, according to the OECD.

Legal consequences for buyers

Buyers of counterfeit products may face significant legal consequences. In France, they may be fined up to twice the value of the genuine product that has been counterfeited. So, if a bag suspiciously resembling a “Kelly” bag is offered for $1,000 on certain websites, the final bill could turn out to be far steeper, especially considering that the starting price of the authentic Hermès bag exceeds €10,000. In addition, buyers may be sentenced to three years’ imprisonment.

During a hearing in the French Senate in April 2025, Delphine Sarfati-Sobreira, the director-general of the Union of Manufacturers for the International Protection of Intellectual Property (Unifab), said [“France is the second-largest country in the European Union in terms of seizures of counterfeit goods”].

The video campaigns, viewed by millions, only fuel the counterfeit market. And buying directly from Chinese platforms does not completely exempt customers from paying customs duties. In the US, customs controls on orders from China have tightened, particularly for small packages below $800.

An opportunity for brands?

The videos also hide a deeper question: how can we justify the value of luxury items? If most brands have remained silent, indicating the lack of credibility they give these campaigns, they might also see this as an opportunity to strengthen communication with customers about preserving their craftsmanship and promoting their heritage.

A weekly e-mail in English featuring expertise from scholars and researchers. It provides an introduction to the diversity of research coming out of the continent and considers some of the key issues facing European countries. Get the newsletter!

The post “examining an online phenomenon and its risks for consumers” by Isabelle Chaboud, Professeur senior d’analyse financière, d’audit et de risk management – Directrice de Programme pour le MSc Fashion Design & Luxury Management- Responsable de la spécialisation MBA "Brand & Luxury Management", Grenoble École de Management (GEM) was published on 09/03/2025 by theconversation.com

Leave a Reply