If ever there was a need to exemplify the term annus horribilis in the annals of corporate history, 2024 and the Boeing Company would be the perfect match. And the year is not even over yet.

The last seven days have seen Boeing face a number of issues. The United States Federal Aviation Administration (FAA) issued an airworthiness directive on July 8 requiring airlines that operate the Boeing 737 Next Generation and the 737 MAX to inspect each aircraft’s oxygen generator system for restraining strap failures within the next five months.

This directive followed multiple reports of passenger oxygen generators shifting out of position — an issue that could prevent passengers from receiving oxygen during an emergency.

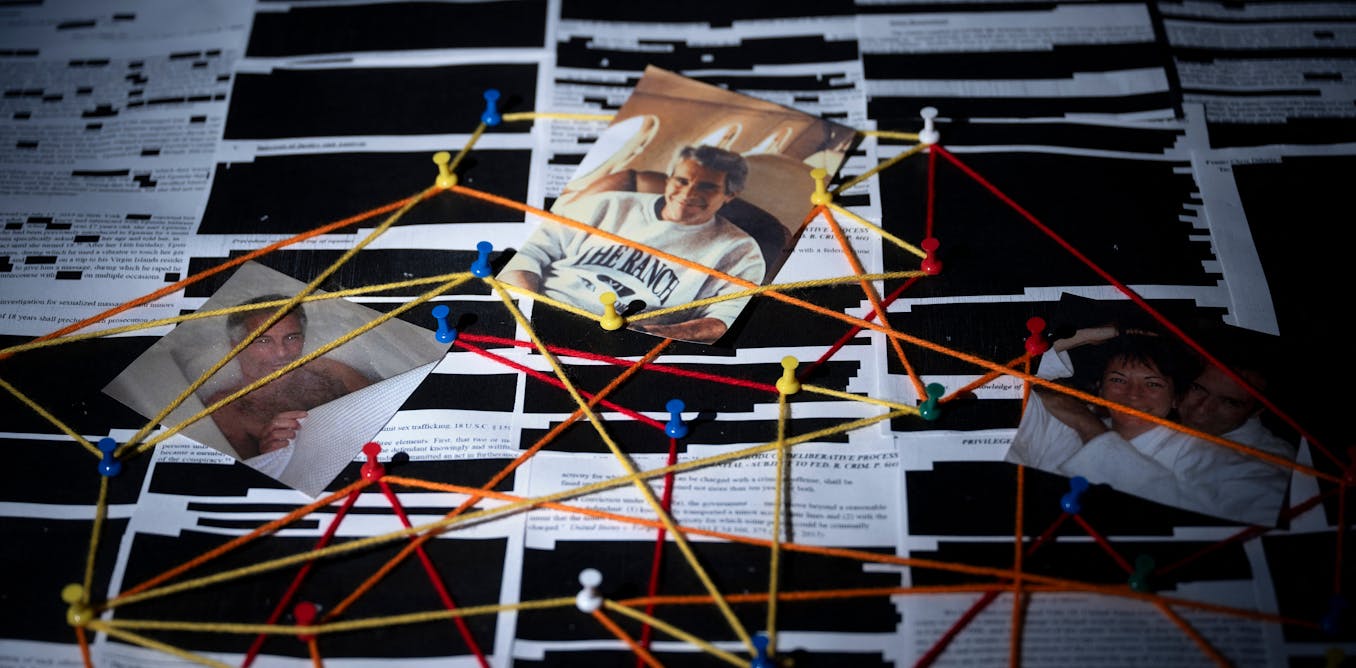

Additionally, Boeing has agreed to plead guilty to a fraud charge resulting from failing to disclose critical design elements to regulators responsible for certifying the 737 MAX aircraft into commercial service.

The U.S. Department of Justice revealed that Boeing agreed to the plea deal on July 7, after the government determined Boeing violated an agreement that had protected it from prosecution.

Landmark plea deal

The plea deal is the culmination of a three-year review process initiated in 2021. Boeing was ordered to demonstrate changes in their operating and production practices that contributed to the 2018 Lion Air and 2019 Ethiopian Airlines crashes, which involved 737 MAX aircraft and resulted in 346 fatalities.

It is estimated that Boeing has lost US$60 billion in sales because of these crashes, and it has seen its profitability reduced by over US$32 billion since 2019. Its debt increased to close to US$50 billion. Beyond the financial impact, the crashes have also had an emotional toll on the families of the victims.

(AP Photo/Jose Luis Magana)

If the plea deal is approved by a federal judge and comes into effect, it will result in additional fines and expenses for the company. Boeing will be fined an additional US$243.6 million and be required to invest at least US$455 million in compliance and safety programs.

Lawyers representing some of the families have been pressing for a rejection of this Department of Justice plea deal, stating that:

“The only way to enact meaningful change at Boeing would be to take action that affects its bottom line, which would mean imposing larger fines and more severe consequences.”

If this challenge is successful and the plea deal is rejected, it will result in a public trial that will require Boeing staff to testify about their roles in deceiving FAA regulators about a flight-control system that was implicated in the crashes. The financial implications for Boeing in such a trial have been estimated to exceed US$25 billion.

Financial and emotional tolls

The aggregate of these events will yet take more of a toll on Boeing. Political and regulatory discussions have highlighted the frustration with Boeing executives who have continued to apologize and promise change.

Whistleblowers have presented a number of failings with Boeing’s assembly practices that have prevented potential safety issues from being addressed while aircraft are on the assembly line.

Read more:

What the Boeing whistleblower’s death reveals about exposing corporate wrongdoing in North America

It is startlingly evident that these failings could impact the safe and reliable operation of the final product. The culprits in these failings have been identified sporadically as the Boeing culture, the Boeing leadership style and the management performance measures in place.

Much has been published about Boeing leadership having morphed from engineering- and quality-focused mindsets to one focused on economics and financial performance.

(Jennifer Buchanan/The Seattle Times via AP, Pool)

Regaining public trust

Can Boeing overcome its current challenges and regain its reputation as a winning corporation? One that its employees, clients and the travelling public can count on to produce commercial aircraft that are safe, comfortable and sustainable?

To do so, the world needs to trust the Boeing brand once again, a trust that was developed through decades of producing aircraft that customers held in high regard for quality and engineering design.

As we await the announcement of a new CEO, the board of directors at Boeing needs to stand before the governance mirror and ask themselves if they have met their entrusted oversight responsibilities.

(AP Photo/J. Scott Applewhite)

It should not come as a surprise that many of Boeing’s directors are long-serving in their roles, bearing responsibility for the missteps taken by management in the recent past.

Recent legal challenges aimed at limiting board members’ liability in instances of corporate mismanagement have failed in the U.S., with the courts reinforcing the need for directors to be aware of corporate malpractices and take action to remedy such instances.

Global aviation in jeopardy

All this raises an important question: is there a risk to Canadian airlines and Boeing’s Canadian supply chain members resulting from this litany of issues?

If the plea agreement is permitted to come into effect, Boeing will be identified as an organization convicted of a felony. As such, it would be subject to a U.S. statute that prevents defence contractors who have been convicted of certain felonies from winning future defence contracts.

Given the nature of Boeing’s presence in both commercial aviation and defence, it seems unlikely this felony conviction will hinder Boeing’s relationships with suppliers and customers.

The world needs Boeing to return to its fabled engineering, safety and quality roots. Global aviation safety depends on the reliability of major aircraft manufacturers. The clock is ticking and Boeing cannot make promises. Actions and results are needed — and needed quickly.

The post “The manufacturer has a long road ahead to regain public trust” by John Gradek, Faculty Lecturer and Academic Program Co-ordinator, Supply Network and Aviation Management, McGill University was published on 07/11/2024 by theconversation.com